Advice to Struggling Mortgage Borrowers in Spain

Raymundo Larraín Nesbitt, March, 8. 2011

Ex-pat landlords are still struggling to remain afloat in 2011. This article provides them with some useful tips.

By Raymundo Larraín Nesbitt

Lawyer – Abogado

8th of March 2011

Introduction

From a global perspective, political instability in the Middle East has sparked tensions fueling oil prices to new record highs. The Japanese tragedy has set the stage for a further rise in commodity prices needed to re-build the country which were already at all-time highs due to China’s ongoing real estate bubble. This in turn has brought a surge in inflation (rise in the general level of prices of goods and services). As a result the European Central Bank is juggling on the one hand unchecked inflation and on the other the budding recovery of an ailing European economy straggled by peripheral economies which in turn are debt-laden. The ECB, de facto heir of the Deutsche Bundesbank, has a mandate to keep inflation at bay. As a result of this commitment it announced it will hike the official interest rate as of April with more hikes to follow along the year.

The problem is that on doing so you run the risk of derailing the budding European recovery spearheaded by Germany tipping the economy into a full-fledged double-dip scenario. So it’s really a matter of balancing priorities in Europe. Peripheral economies vs. export-oriented countries. The former, saddled with debt, will be the ones bearing the brunt of a rise of interest rate while the latter will reap the benefits. Mind you, a sharp rise in interest rates would also hurt the latter. The choice, seemingly, has already been made by the ECB.

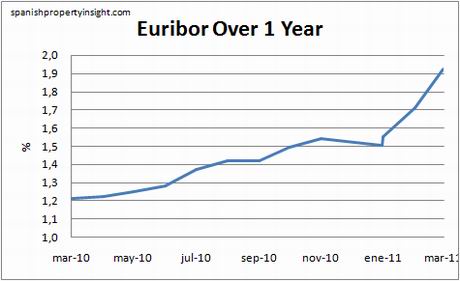

The Euribor rate (to which most Spanish mortgages are referred to) has already risen in anticipation of the foreseen hike. This will translate into higher mortgage repayments. With hundred of thousands of Spanish mortgages already underwater this could not come at a worst time.

From a national perspective, the Spanish Government is bent on closing the ever-widening deficit having decided to clampdown on black money in an effort to prop up its dwindling coffers. As a result the AEAT (Spain’s equivalent to HMRC) will be taking a number of new measures such as cross-referencing with utility companies household consumption as from March to detect undeclared rentals which are rife in Spain. The afore measure will have foreseeable side effects.

Landlords with undeclared lets will now be faced with the grim prospect of either disclosing the let (maybe even raising it so as to offset rental taxes) or else continue at large running the risk of getting caught and fined by the local tax authorities. The afore is compounded and aggravated by the fact that ex-pat landlords normally use the rental income to offset their Spanish mortgage repayments. At a time when rentals vastly outstrip demand in Spain, and good-paying tenants are increasingly hard to come by, this couldn’t come at a worst time. It is doubtful a tenant will cave in to a landlord’s demand to raise the let to offset the associated taxes. The tenant will probably opt to move elsewhere as nowadays they will be spoilt for choice.

All the above will bring about additional headaches to already struggling ex-pat landlords. British will be particularly worst off due to the strengthening of the Euro against Sterling over the last couple of years.

With the above in mind, I’ve written this article in anticipation of the financial problems that are to come for many borrowers in Spain.

Tips to Struggling Mortgage Borrowers

1. Swap to interest-only (“carencia”). This can be arranged whilst the property is put up for sale or just to weather off the storm meanwhile. This option has become increasingly difficult post credit-crunch as Spanish banks seldom grant interest-only and when they do, it’s really just as a teaser for two years at most.

2. Extending mortgage repayments an additional number of years. The drawback is that on doing so the amount of interests you pay on the long run are increased dramatically. So it’s only an option for those left with no other really. The Government is now allowing this change free of charge to struggling mortgage borrowers providing they are resident and the property is their permanent dwelling. Borrowers will not pay for Notary or Land Registry fees on following it.

3. Dación en pago. This is basically handing over the keys back to the lender and signing a deed at the Notary whereby the lender commits itself not to chase you for the outstanding debt and considers it discharged for good. Two things are required, the property must not have slipped into negative equity and ideally there should be, as rule-of-thumb, at least 20% equity so as to offset the lenders’ expenses on taking over the property. It doesn’t matter if you are already in arrears, what does matter is that the repossession procedure must not have been started by the lender. Should the property be in negative equity (you owe more than what the property is worth) a lender will be very reluctant to agree to a “dación en pago de deuda” because the collateral will have no equity left. Please read my article Dación en Pago or Handing Back the Keys for more details.

4. Selling the property as a distressed asset. If you have already run through the numbers and you are convinced that you will no longer be able to service your mortgage, rather than defaulting and being repossessed, you should very seriously consider selling the property as a distressed asset. The catch again is that the property should not be in negative equity. The more it is the least likelihood there will be anyone interested in it as they in turn are regarding the purchase as an investment and the numbers need to stack up to make it worthwhile for them.

5. Applying for debt consolidation. There are many financial companies offering this service. Basically what they do is group together all your existing debts with different lenders (ranging from credit card debt to personal loans) with one lender who then extends the loan repayments. The consequence this has is that your monthly repayments are cut down significantly making them more affordable. However the drawback once again is that on extending the financial commitments you will be paying more interest over time.

6. Swapping the mortgage to a new lender. Many lenders are now offering to take on existing mortgages going as far as paying all the transfer expenses. Lenders will normally require the property was bought prior to 2003. This is because properties purchased before this date are deemed as “safe” (not in risk of being in negative equity). In addition, for those who hold collar clauses (“cláusula suelo”), swapping over to another lender offers the opportunity to get rid of these bothersome clauses and take advantage of the low interest rates. Moreover, new rulings have declared collar clauses as abusive (something which incidentally I had already pointed out in my article on 10 Common Abusive Clauses in Spanish Mortgage Loans). These rulings are forcing lenders to scrape them off their existing mortgage contracts within the next two months of the ruling as well as not to include them in new contracts.

7. Filing for personal bankruptcy in Spain. This procedure is expensive albeit it allows those who can afford it to buy considerable time (years) with which to re-negotiate your financial commitments and even reduce the amount owed (up to 30%). A judicially-appointed administrator will be tasked to oversee and manage your day-to-day financial affairs in the interim. Meaning you lose control over all your assets needing to request permission. I would only recommend this option in exceptional cases as it will turn you into a lifetime financial pariah. This is not an option for most people.

In Conclusion

My advice is to draw the red line on a repossession procedure. You should try to avoid this scenario at all costs. As the debt goes personally against the borrower in Spain, you may live a nightmare with debt-collecting agencies, banks or lawyers knocking at your door for years to come. As the compound default interest is fairly high this will be rolled up to what you already owe creating a mounting debt spiral.

A lawyer can help a struggling borrower to achieve the above tips successfully averting a debt spiral drawing a line to protect your family assets.

Larraín Nesbitt Lawyers, small on fees, big on service.

Larraín Nesbitt Lawyers is a law firm specialized in inheritance, conveyancing, taxation and litigation. We will be very pleased to discuss your matter with you. You can contact us by e-mail at info@larrainnesbitt.com, by telephone on (+34) 952 19 22 88 or by completing our contact form.

Legal services Larraín Nesbitt Lawyers can offer you

Related articles

- Lifetime Loans or Reverse Mortgages in Spain Explained – 21st February 2011

- Advice to Struggling Mortgage Borrowers in Spain – 8th March 2011

- Spanish Mortgage Loans: Beware of Abusive Clauses – 8th January 2012

- Spanish Mortgage Loans: An Overview – 21st February 2012

- Mortgage Collar Clauses Revisited (‘Cláusulas Suelo’) – 8th December 2013

- Bank Repossessions in Spain – 21st February 2014

- Bad Debtor’s List (‘Fichero de Morosos’) – 8th April 2014

- Spanish Creditors Pursuing Debts Abroad – 8th May 2014

- Dación en Pago Explained or How to Hand Back the Keys – 8th December 2014

Please note the information provided in this article is of general interest only and is not to be construed or intended as substitute for professional legal advice. This article may be posted freely in websites or other social media so long as the author is duly credited. Plagiarizing, whether in whole or in part, this article without crediting the author may result in criminal prosecution. VOV.

2.011 © Raymundo Larraín Nesbitt. All rights reserved.